Pursuant to Decree No. 126/2020/ND-CP dated October 19th, 2020 detailing a number of articles of the Law on Tax Administration;

Pursuant to Circular 111/2013/TT-BTC dated August 15th, 2013 guiding the implementation of the Law on Personal Income Tax (PIT).

Japan Securities Incorporation (JSI) would like to inform that we will declare and pay PIT on income from capital investment on behalf of Clients, specifically as follows:

1. Time of implementation: from December 5th, 2020.

2. Subjects of application:

– Individual investors receiving shares as stock’s dividend; individual who is shareholder receiving shares as bonus, of which the allocation date is from December 5th, 2020.

3. Time of PIT declaration and payment: When individual investors sell / transfer shares received as stock’s dividend / bonus.

4. Tax calculation: PIT = Taxed income x 5% Tax rate.

Inside:

- Taxed income = Number of shares sold / transferred * Taxed price.

- Number of shares sold / transferred: the number of stock’s dividend / bonus is sold/transferred and priotize PIT calculation from time of selling until the total stock dividend/bonus is over.

- Taxed price:

If selling / transferring price ≥ par value (VND 10,000): Taxed price = par value.

If selling / transferring price <par value (10,000 VND): Taxed price = selling price / transferring price.

5. Example:

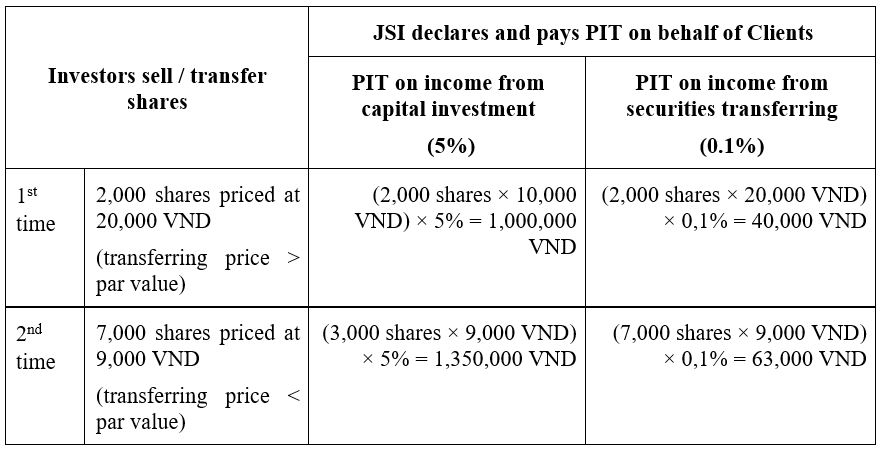

Mr. A is a shareholder owning 10,000 shares of X Joint Stock Company (listed on the Stock Exchange). In 2020, Mr. A received 5,000 additional shares as dividend of Company X (par value is 10,000 VND). On December 10th, 2020, Mr. A transferred 2,000 shares of company X at the price of 20,000 VND / share. On December 30th, 2020, Mr. A transferred 7,000 shares at the price of VND 9,000 / share.

When transferring, Mr. A must pay personal income tax on the income from capital investment and the income from securities transferring, specifically as follows:

Please contact +84-24-3791-1818 (Brokerage Department) if you have any questions.